Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Transforming how individuals and businesses in Nepal access loans, capital

and investment opportunities.

At Trust Bridge we make financial decisions smarter, faster, and more transparent through a blend of trust, technology, and expertise.

Accelerate credit access with a cutting-edge, technology-driven lending platform designed for speed.

Connect people to essential capital through our streamlined financial product distribution network.

Revolutionize digital finance with our comprehensive mobile fintech platform and expert services.

Unlock high-value opportunities by diversifying portfolios through our strategic alternative investment plans.

Reimagining how financial institutions and consumers access credit, technology, and investment opportunities through powerful digital platforms, data-driven decisioning, and trusted advisory.

Revolutionizing financial solutions with innovation, transparency, and user-centric design to shape a smarter, more connected financial future.

Led by industry leaders with deep experience in digital finance,lending, and alternative investments.

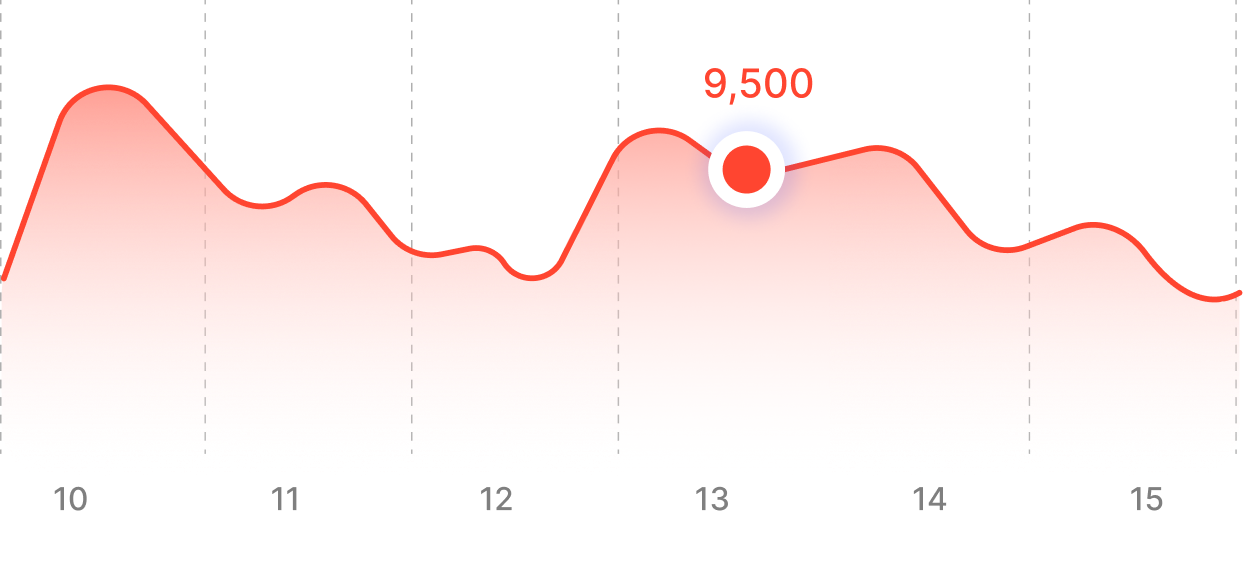

Proven platforms powering 30,000+ loans monthly and platform used by over 1 million customers across Nepal.

AI-driven decisions, mobile-first design, and data intelligence built to transform financial institutions.

Focused on financial inclusion, last-mile access, and creating new opportunities in frontier sectors.

See how our digital-first financial services have empowered clients to make smarter decisions and reach their goals.

“For a freelancer, traditional banks are really archaic. With Earney, I know exactly how much I pay for every service I need.”

Founder | CEO

“For a freelancer, traditional banks are really archaic. With Earney, I know exactly how much I pay for every service I need.”

Founder | CEO

“For a freelancer, traditional banks are really archaic. With Earney, I know exactly how much I pay for every service I need.”

Founder | CEO

“For a freelancer, traditional banks are really archaic. With Earney, I know exactly how much I pay for every service I need.”

Founder | CEO

“For a freelancer, traditional banks are really archaic. With Earney, I know exactly how much I pay for every service I need.”

Founder | CEO

“For a freelancer, traditional banks are really archaic. With Earney, I know exactly how much I pay for every service I need.”

Founder | CEO

Everything you need to know about how we simplify, guide, and support

your financial journey.

Trust Bridge Capital operates through four core business pillars:

Through The Lending Turbo, Trust Bridge Capital offers an end-to-end digital lending system that includes:

This allows financial institutions to transition from traditional manual lending to a fully digital, efficient, and scalable model.

Yes. The platforms and services provided by Trust Bridge Capital are designed for secure, compliant, and reliable financial operations. The company works closely with regulated financial institutions and implements structured, transparent systems — especially within digital lending and SPV investment frameworks.

Trust Bridge Capital offers solutions for different types of customers:

Each solution is designed with clarity, analytics, and expert oversight, helping users make smarter financial decisions.

Trust Bridge Capital stands out because it combines technology ownership, direct customer access, and financial intermediation in one ecosystem. According to your PDF:

Yes. Trust Bridge Capital has plans to collaborate with Microfinance Institutions, Cooperatives, NBFCs and additional regulated financial partners.

Pay out fiat or crypto to your users in more than 50+ Countries with a single dashboard.